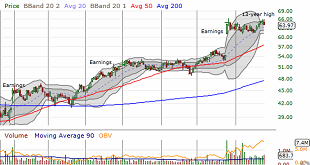

Meritage Homes (MTH) shut the latest exchanging day at $176.57, moving +0.58% from the past exchanging meeting. The stock outflanked the S&P 500, which enrolled a day to day gain of 0.14%. Somewhere else, the Dow acquired 0.3%, while the tech-weighty Nasdaq added 0.16%.

The supply of homebuilder has ascended by 26.14% in the previous month, driving the Development area’s benefit of 14.08% and the S&P 500’s benefit of 4.89%.

Market members will be intently following the monetary consequences of Meritage Homes in its forthcoming delivery. The organization intends to declare its profit on January 31, 2024. The organization’s income per share (EPS) are projected to be $5.17, mirroring a 27.08% diminishing from a similar quarter a year ago. Our latest agreement gauge is calling for quarterly income of $1.52 billion, down 23.54% from the year-prior period.

MTH’s entire year Zacks Agreement Assessments are calling for income of $19.67 per offer and income of $5.98 billion. These outcomes would address year-over-year changes of – 26.44% and – 4.54%, individually.

Any new changes to expert assessments for Meritage Homes ought to likewise be noted by financial backers. These new modifications will generally mirror the developing idea of momentary business patterns. Accordingly, positive amendments in gauges convey examiners’ trust in the organization’s business execution and benefit potential.

Our exploration proposes that these progressions in gauges have an immediate relationship with impending stock cost execution. To take advantage of this, we’ve shaped the Zacks Rank, a quantitative model that incorporates these gauge changes and presents a reasonable rating framework.

The Zacks Rank framework, crossing from (Serious areas of strength for #1) to #5 (Solid Sell), brags a noteworthy history outperformance, evaluated remotely, with #1 positioned stocks yielding a normal yearly return of +25% beginning around 1988. Over the course of the last month, the Zacks Agreement EPS gauge has stayed consistent. As of now, Meritage Homes brags a Zacks Rank #3 (Hold).

As for valuation, Meritage Homes is right now being exchanged at a Forward P/E proportion of 8.93. This communicates a rebate contrasted with the typical Forward P/E of 10.31 of its industry.

The Structure Items – Home Manufacturers industry is important for the Development area. This industry, as of now bearing a Zacks Industry Position of 69, winds up in the top 28% echelons of every 250+ industry.

The Zacks Business Rank surveys the life of our particular industry bunches by figuring the typical Zacks Position of the singular stocks consolidated in the gatherings. Our exploration shows that the top half evaluated businesses beat the base half by a variable of 2 to 1.

Remember to utilize Zacks.com to monitor this multitude of stock-moving measurements, and others, in the forthcoming exchanging meetings.