Some Meritage Homes Enterprise (NYSE:MTH) investors might be somewhat worried to see that the Chief VP, Phillippe Ruler, as of late sold a significant US$1.0m worth of stock at a cost of US$146 per share. Nonetheless, it’s urgent to take note of that they remain a lot of put resources into the stock and that deal just diminished their holding by 8.2%.

Meritage Homes Insider Exchanges Throughout the past Year

As a matter of fact, the new deal by Leader VP Phillippe Master was not their main offer of Meritage Homes shares this year. Prior in the year, they brought US$107 per share in a – US$1.7m deal. That implies that in any event, when the offer cost was underneath the ongoing cost of US$151, an insider needed to trade out certain offers. We for the most part think of it as a negative on the off chance that insiders have been selling, particularly assuming they did as such underneath the ongoing cost, since it infers that they believed a lower cost to be sensible. While insider selling is certainly not a positive sign, we can’t rest assured on the off chance that it implies insiders think the offers are completely esteemed, so it’s just a feeble sign. We note that the greatest single deal was just 14%of Phillippe Master’s holding.

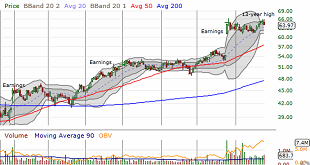

Meritage Homes insiders purchased no offers throughout the past year. You can see a visual portrayal of insider exchanges (by organizations and people) throughout recent months, underneath. Assuming you click on the graph, you can see every one of the singular exchanges, including the offer cost, individual, and the date!

Does Meritage Homes Flaunt High Insider Possession?

Numerous financial backers like to check the amount of an organization is possessed by insiders. A high insider proprietorship frequently makes organization initiative more aware of investor interests. Meritage Homes insiders own about US$103m worth of offers (which is 1.9% of the organization). I like to see this degree of insider possession, since it expands the possibilities that administration are pondering the wellbeing of investors.

What Could The Insider Exchanges At Meritage Homes Tell Us?

An insider sold stock as of late, yet they haven’t been purchasing. Focusing on the most recent a year, our information shows no insider purchasing. It is great to see high insider proprietorship, yet the insider selling leaves us mindful. As well as being familiar with insider exchanges going on, it’s valuable to recognize the dangers confronting Meritage Homes. Keeping that in mind, you ought to find out about the 2 advance notice signs we’ve spotted with Meritage Homes (counting 1 which ought not be overlooked).

Obviously, you could find a fabulous speculation by looking somewhere else. So take a look at this free rundown of intriguing organizations.

For the motivations behind this article, insiders are those people who report their exchanges to the applicable administrative body. We at present record for open market exchanges and confidential demeanors of direct interests just, however not subsidiary exchanges or roundabout interests.