With a cost to-profit (or “P/E”) proportion of 7.9x Meritage Homes Company (NYSE:MTH) might be conveying extremely bullish messages right now, considering that close to half of all organizations in the US have P/E proportions more noteworthy than 17x and even P/E’s higher than 33x are generally typical. Be that as it may, the P/E may be very low for an explanation and it requires further examination to decide whether it’s legitimate.

While the market has encountered profit development of late, Meritage Homes’ income have gone into turn around gear, which isn’t perfect. It appears to be that many are anticipating that the dreary income execution should continue, which has subdued the P/E. Assuming you actually like the organization, you’d trust this isn’t the case so you might actually get some stock while it’s undesirable.

Is There Any Development For Meritage Homes?

Meritage Homes’ P/E proportion would be run of the mill for an organization that is supposed to convey exceptionally unfortunate development or in any event, falling profit, and critically, perform a lot of more terrible than the market.

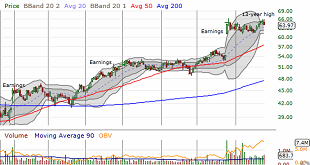

Reflectively, the last year conveyed a baffling 17% diminishing to the organization’s main concern. In any case, the most recent long term time frame has seen a great 122% in general ascent in EPS, regardless of its sub-par momentary execution. So we can begin by affirming that the organization has commonly done an excellent occupation of developing profit throughout that time, despite the fact that it had a few hiccups en route.

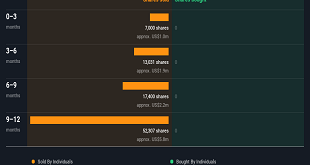

Moving to what’s in store, gauges from the nine experts covering the organization recommend profit development is going into a negative area, declining 13% throughout the following year. That is not incredible when the remainder of the market is supposed to develop by 10%.

Considering this, it’s justifiable that Meritage Homes’ P/E would sit beneath most of different organizations. In any case, contracting income are probably not going to prompt a steady P/E over the more drawn out term. Indeed, even keeping up with these costs could be hard to accomplish as the powerless viewpoint is burdening the offers.

The Last Word

While the cost to-profit proportion ought not be the characterizing factor in regardless of whether you purchase a stock, it’s a seriously skilled gauge of income assumptions.

We’ve laid out that Meritage Homes keeps up with its low P/E on the shortcoming of its gauge for sliding income, true to form. This moment investors are tolerating the low P/E as they surrender future income most likely will not give any wonderful little treats. It’s difficult to see the offer cost rising emphatically sooner rather than later under these conditions.